As a general rule, it is the responsibility of the tenants to pay a council tax bill when renting a property - similar to other utility bills like water, gas and electricity. This is usually detailed within the tenancy agreement and the arrangement with bills is typically discussed ahead of moving in with either the landlord or letting agent. As we will see however, there are some exceptions to this.

What is Council Tax?

Council tax is set by the local authority and is a tax designed to cover the services provided by the local authority like refuse collection, leisure services and highway maintenance. Typically it is usually paid by direct debit in 10 instalments across the tax year (the tax year starts in April).

How much is the Council Tax?

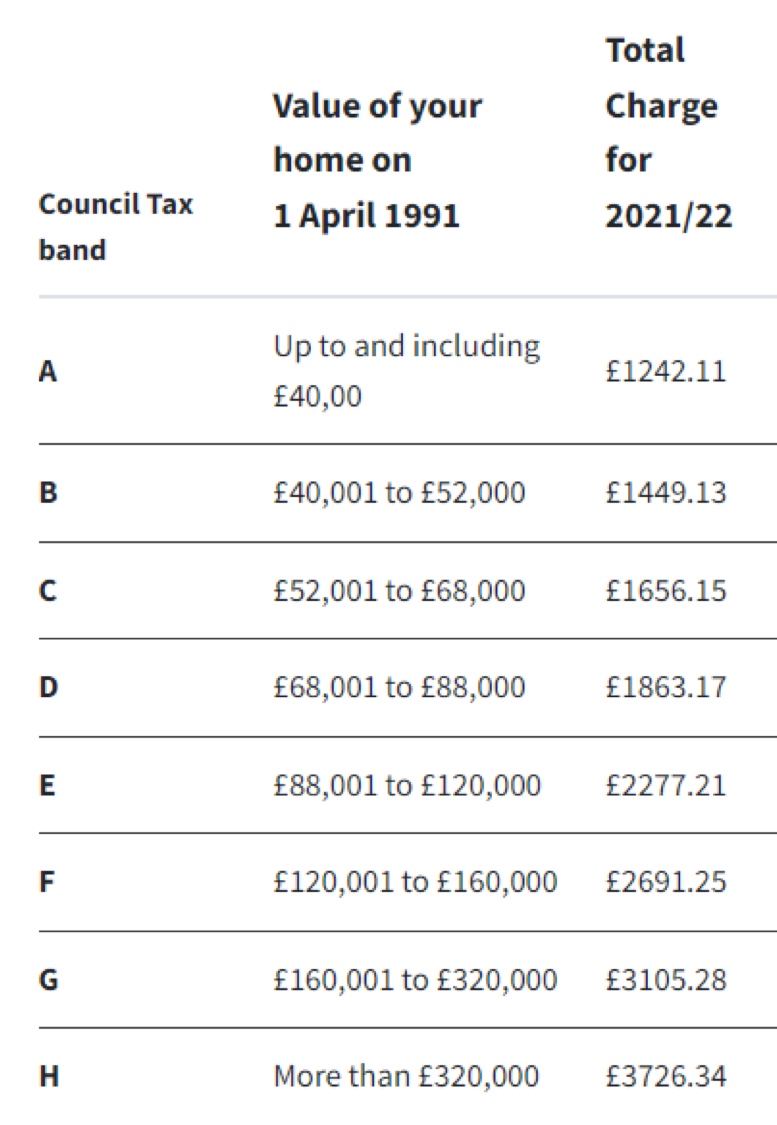

How much council tax you pay will vary by where you live and also the value of your property. In total, there are 8 different bands a property falls into and these are bands A to H. The actual value of the property isn't assessed every year, or even every 10 years.

How much the property is worth is actually based on its value back in April 1991 and the bands are worked out by the HM Revenue and Customs Valuation Office

Below are the council tax charges and bands for the London Borough of Waltham Forest which covers Chingford, Walthamstow, Leyton and Leytonstone:

These figures don’t take account of any discounts, benefits, or other reductions you may be entitled to and the latest information can be found on the Waltham Forest website.

Who pays Council Tax in rental property - tenant or landlord?

Generally speaking, the council tax is paid by the occupant. So if you're a tenant, you will pay the council tax.

For example, if there is one tenancy agreement (typically an AST) then all the signatories on the tenancy agreement are regarded as being jointly responsible for paying the council tax bill.

If the property is rented out to several tenants on separate tenancy agreements then, as a general rule, the landlord is responsible for paying the council tax although the cost of this is typically added to the rent that is being paid.

Is the landlord ever responsible for paying Council Tax?

Apart from the example above the main example of where a landlord will be responsible is where their is a council tax on empty properties - either in between tenancies or, for example, if work is being carried out on the property. Any tax on empty properties is the responsibility of the property owner.

Council Tax discounts for tenants.

Discounts are available if certain criteria are met.

Information on .Gov.uk states:

You’ll get 25% off your bill if you count as an adult for council tax and either:

you live on your own

no-one else in your home counts as an adult

You’ll usually get a 50% discount if no-one living in your home, including you, counts as adults

You are not counted as an adult for the purposes of council tax under the following criteria:

children under 18

people on some apprentice schemes

18 and 19-year-olds in full-time education

young people under 25 who get funding from the Skills Funding Agency or Young People’s Learning Agency

student nurses

foreign language assistants registered with the British Council

people with a severe mental impairment

live-in carers who look after someone who is not their partner, spouse, or child under 18

diplomats

Additionally, you don't have to pay any council tax if everyone in the home is a full time student.

Is the Council Tax bill correct?

Given council tax bills are based on property valuations from 1991 it is important to check the property you're renting is in the correct band.

CreditLadder can help you improve your credit score

If you want to improve your credit position by reporting your rent payments, CreditLadder is the only way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money.

CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the information provided in this article is for information purposes only and should not be considered as advice.