Money off your energy bills now

Having seen what felt like multiple Prime Ministers and Budgets over the past few months it’s important to remember in the midst of the cost of living crisis some help has been made available - make sure you’re not missing out. Some of the help is currently available, and more will follow in April 2023.

Get £400 off your Energy Bills

One payment every household will qualify for is a £400 energy bill discount - irrespective of their income or savings. The energy discount started in October 2022 and will be applied over 6 months, so either a £66 or £67 credit will be applied every month for 6 months in total. If you have a domestic electricity meter point then you will automatically receive a deduction on your bill if you pay via payment cards, standard credit or direct debit. If you use a prepayment meter then you will be provided with discount vouchers in the first week of each month. It is therefore important that your details are up to date with your utility supplier. Check your utility bills and if you have not received your discounts then contact your energy supplier!

Do I need to pay back the £400?

No, there is no requirement to pay the £400 back.

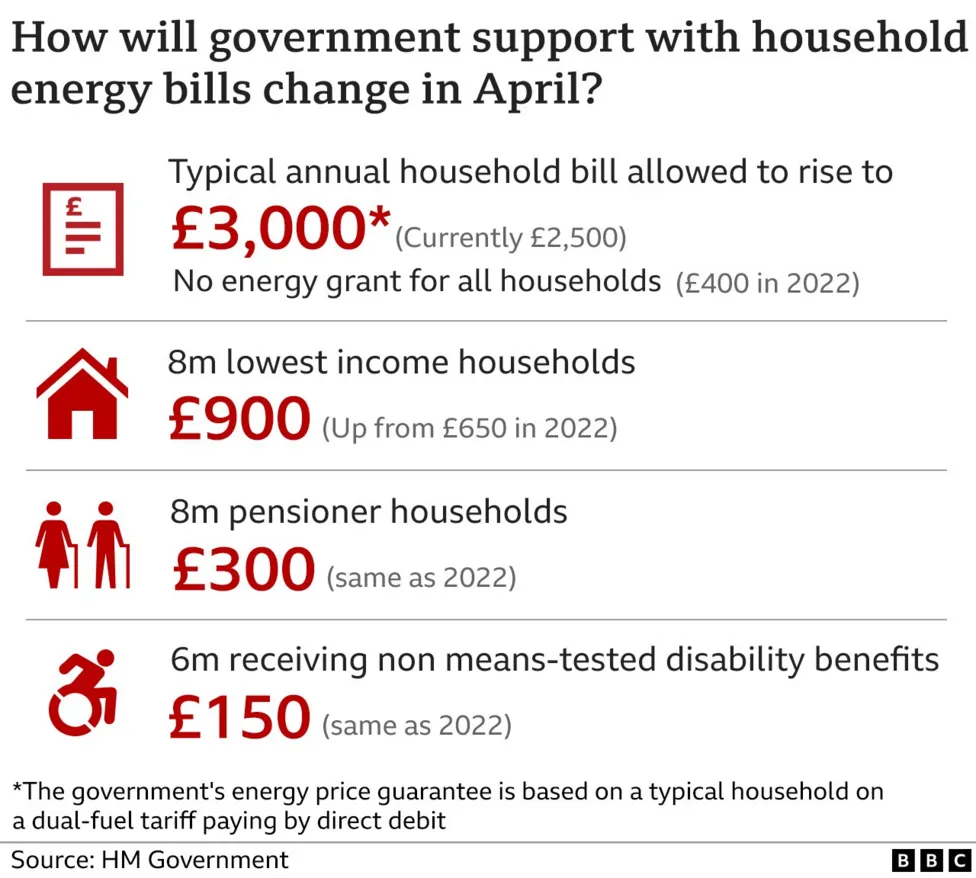

Further government support with household bills from April 2023

Who gets the savings if I am in a flat or house share?

The savings will come straight off the energy bill so the actual bill will be lower. That means when it comes to paying for your share of the bill, the bill will be £400 lower meaning your share will also be lower.

Energy price cap extended beyond April 2023

The guarantee was due to end in April 2023 but it has been extended for a further year. It’s important to know the price cap doesn’t cap your bills - it caps the unit rate your utility supplier charges you.

Summary

There is additional help available through local councils Vulnerable families can also claim help through the Household Support Fund, and the Warm Home Discount scheme.

CreditLadder can help you improve your credit score

If you want to improve your credit position by reporting your rent payments, CreditLadder is the only way to improve your credit score and position across all four of the main Credit Reference Agencies in the UK, namely Experian, Equifax, TransUnion and Crediva. Building up a high credit score has a lot of benefits, including helping you access finance at better rates - this can also help save you money.

CreditLadder also runs a free mortgage application service in partnership with Tembo which will tell you how much you could borrow.

Remember the information provided in this article is for information purposes only and should not be considered as advice.